Getting Started

We Have Simplified the Process of Securing an Insurance Agency or Financial Advisory Loan

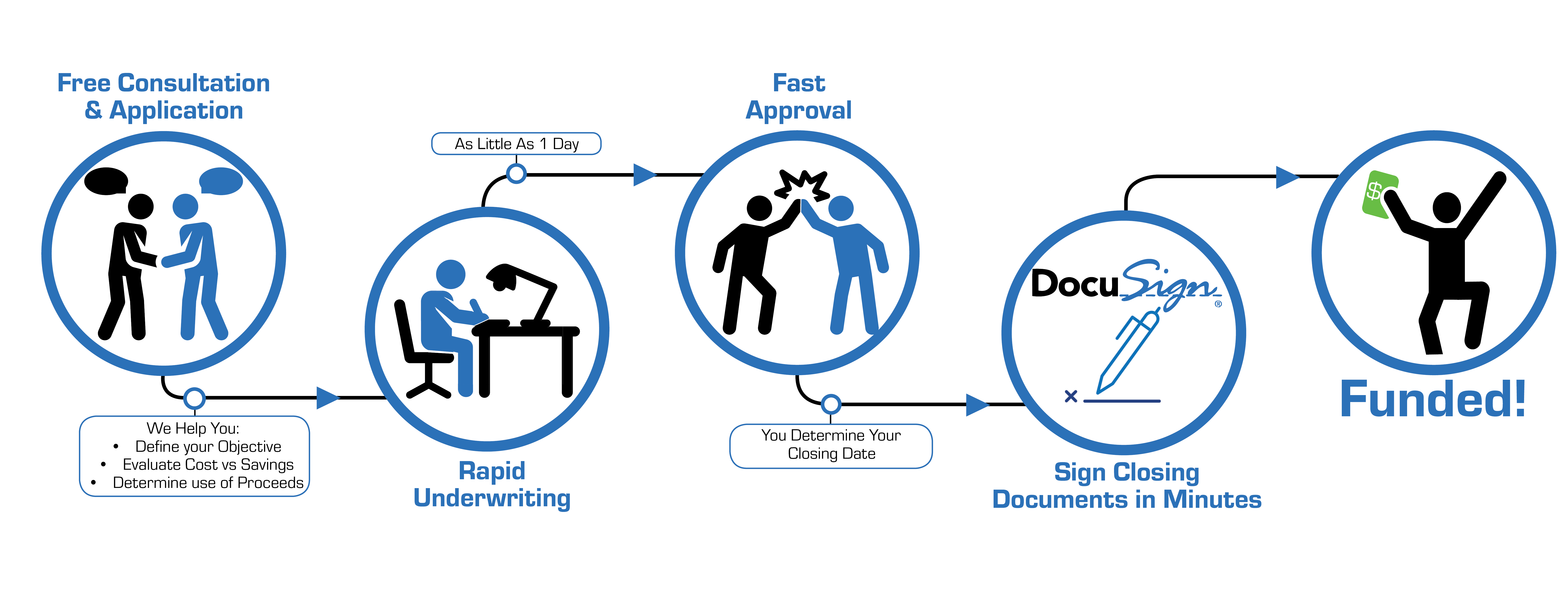

Our Process

You’ve made the decision to start, expand, or acquire an insurance agency or financial advisor practice, now what? The lending experience can be a confusing one, especially for first-time borrowers. Capital Resources strives to reduce the overwhelming nature of the lending experience by educating all borrowers on the overall process, and breaking it down into easy-to-follow steps.

Choosing a Lender

After you’ve made the decision to make the investment into your future, you now need to determine which lender is right for you. When it comes to finding the right lender, many head straight for the bank. Unfortunately, banks are often held captive to their own products, and have a limited knowledge of the insurance and financial advisory industry. This means that they often won’t offer unbiased lending advice and have a restricted variety of lending products available.

Capital Resources, on the other hand, offers a wide variety of insurance agency and financial advisory loans, and is able to tailor these loans to directly fit your needs. Having focused exclusively on insurance agency and financial advisory practice lending since 2005, we have a deep understanding of these industries, and are committed to offering our customers the best loan products available.

Learn more about choosing a lender for your insurance agency or financial advisory loan.

Determining Which Loan is Right for You

Capital Resources knows that choosing the right loan is both incredibly important and at times overwhelming. To help with loan selection, we have loan specialists on hand who know both the insurance industry, and the financial advisory industry intimately. Our specialists will start by listening to you in an effort to learn what your goals are first. Then, we will walk you through each product to help you find the loan that will best help you achieve your professional goals. A few additional ways you can help yourself expedite the loan selection process include:

- Determining your specific professional goals

- Prioritize what are the most important loan variables to you (payment, interest rate, fees, etc.)

- Know how lenders define risk

Application Process

The first step in the lending process is completing an application. This may be done online or on paper. To help streamline the application process, it is best to have all necessary paperwork prepared ahead of time. Paperwork that you will need for the loan application may include:

- 3 years of personal and agency taxes

- 3 years of commission reports

- All financial information about possible acquisitions

- Statements of cash flow for the agency

- Personal financial statement

- Credit application

Approval Process

At Capital Resources, we are able to underwrite and approve a new loan application as quickly as the same day all of the information is submitted.

Closing Process

After your loan has been approved, we will work with you to coordinate a loan funding date that fits within your desired timeline. Capital Resources utilizes ![]()

for all of our closing documents. This will save you days or even weeks getting you the money you need, when you need it.

Once all documents have been executed, we will ACH transfer loan proceeds to the appropriate recipients on the scheduled loan closing date.

Capital Resources is committed to the success of each of our customers. If you have any questions about our lending products or services, or even the lending process, please contact one of our loan specialists.